Cross-border taxation for remote work involves understanding tax obligations in both your home country and the country where you work. Compliance is crucial to avoid double taxation.

Remote work has become increasingly popular, allowing individuals to work from anywhere in the world. This flexibility, however, brings complexities in taxation. Cross-border taxation requires understanding the tax laws of both the home country and the foreign country. Different countries have varying rules, and some have tax treaties to prevent double taxation.

Employers and employees need to be aware of these regulations to ensure compliance. Proper planning can help minimize tax liabilities and avoid legal issues. Keeping up with changing tax laws is essential for anyone working remotely across borders.

Credit: www.cdhcpa.com

Introduction To Cross Border Taxation

Remote work is growing fast. It offers freedom to work from anywhere. But it also brings new tax challenges. Cross border taxation is one of them. It affects how remote workers pay taxes in different countries.

Understanding cross border taxation is crucial. It helps avoid double taxation. It also ensures compliance with international tax laws. Let’s explore the key aspects of cross border taxation for remote work.

Remote Work Trends

Remote work is a global trend. Many workers now prefer it. Companies also support remote work. It reduces office costs and expands the talent pool.

The COVID-19 pandemic accelerated this trend. Many businesses adopted remote work models. This shift created new opportunities and challenges. One key challenge is managing cross border taxation.

Tax Implications

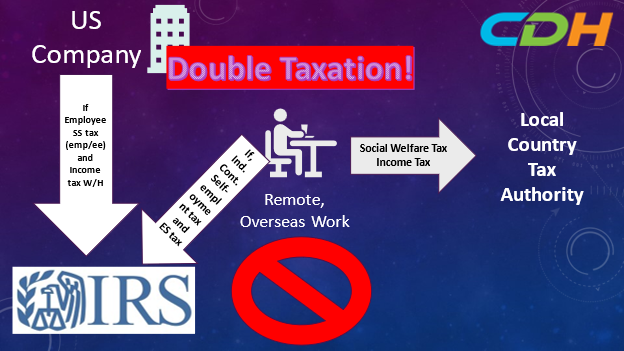

Cross border taxation impacts remote workers. They may face tax obligations in multiple countries. This depends on tax residency rules and income source.

Here are some key tax implications:

- Double Taxation: Workers might pay taxes in two countries.

- Tax Treaties: Treaties can prevent double taxation. They provide relief and define tax rules.

- Tax Residency: Residency rules determine where taxes are owed.

- Compliance: Workers must follow tax laws in both countries.

Understanding these implications is vital. It helps remote workers manage their taxes better.

Understanding Tax Residency

Tax residency is a crucial topic for remote workers. It determines where and how you pay taxes. Many countries have different rules about tax residency.

Residency Rules

Each country has its own residency rules. These rules decide if you are a tax resident. Usually, the number of days you stay in a country affects your residency status.

For instance:

- 183-day rule: Many countries use this rule. If you stay more than 183 days, you are a resident.

- Permanent home: Having a home in a country can make you a resident.

These rules ensure everyone pays their fair share of taxes.

Impact On Taxation

Your tax residency status impacts your tax obligations. As a tax resident, you might need to pay taxes on worldwide income. Non-residents usually pay taxes only on local income.

Consider this table:

| Residency Status | Tax Obligations |

|---|---|

| Resident | Pay taxes on worldwide income |

| Non-Resident | Pay taxes only on income earned locally |

Understanding your status helps you avoid double taxation. It also helps you comply with local tax laws.

Double Taxation Agreements

Working remotely across borders creates tax challenges. One key challenge is double taxation. This happens when two countries tax the same income. Double Taxation Agreements (DTAs) help solve this issue. DTAs ensure fair tax distribution between countries.

What Are Dtas?

Double Taxation Agreements (DTAs) are treaties between two countries. Their main purpose is to prevent double taxation. They ensure taxpayers are not taxed twice on the same income. DTAs cover various types of income, such as:

- Salaries

- Dividends

- Interest

- Royalties

Each DTA is unique. It reflects negotiations between the countries involved. These agreements also promote international trade and investment.

How Dtas Work

DTAs work by allocating taxing rights between countries. They set rules on which country can tax specific income. The main principles include:

- Residence: Where the taxpayer is a resident.

- Source: Where the income is generated.

For example, consider a remote worker in Country A, earning from Company B in Country C. The DTA between Country A and Country C will decide who taxes the income.

DTAs also avoid tax discrimination. They ensure fair treatment for residents of both countries. They often include methods to eliminate double taxation, such as:

- Exemption Method: One country exempts the income taxed by the other.

- Credit Method: One country gives credit for the tax paid in the other.

These methods ensure taxpayers do not pay tax twice on the same income.

Tax Compliance For Remote Workers

Remote work offers great freedom but brings tax challenges. Understanding tax compliance is crucial for remote workers. It helps avoid penalties and ensures peace of mind.

Filing Requirements

Remote workers must understand their filing requirements. Each country has different rules. Knowing your tax obligations is essential.

Here are some common filing requirements:

- Report all income earned, both domestic and international.

- File tax returns in both home and work countries.

- Pay taxes in countries where income is sourced.

- Keep detailed records of all earnings and expenses.

Common Mistakes

Remote workers often make mistakes in tax compliance. These mistakes can lead to fines and other issues.

Common mistakes include:

- Failing to report all income.

- Not understanding double taxation agreements.

- Missing deadlines for filing tax returns.

- Ignoring tax obligations in the host country.

Avoid these mistakes by staying informed and seeking professional help.

Social Security Contributions

Working remotely across borders has raised questions about social security contributions. Employees and employers must understand their obligations. Social security contributions ensure access to benefits like healthcare, pensions, and unemployment insurance.

Bilateral Agreements

Many countries have bilateral agreements to avoid double social security contributions. These agreements determine which country’s social security system applies. They usually prevent paying into two systems simultaneously.

For example, the United States has agreements with several countries. These agreements allow workers to pay social security in just one country. It helps reduce the financial burden on remote workers.

Exemptions

Some workers may qualify for exemptions from social security contributions. Exemptions depend on the specific bilateral agreement between countries. Workers should check the terms of the agreement.

Exemptions can be temporary or long-term. Temporary exemptions often apply to short-term assignments. Long-term exemptions might apply to permanent relocations. Understanding these exemptions can save remote workers money.

Here is a table summarizing key points about exemptions:

| Type of Exemption | Duration | Eligibility |

|---|---|---|

| Temporary | Up to 5 years | Short-term assignments |

| Long-term | More than 5 years | Permanent relocations |

In summary, understanding social security contributions for remote work is crucial. Bilateral agreements and exemptions can simplify the process. Always check the specific terms relevant to your situation.

Employer Considerations

Understanding cross-border taxation for remote work can be complex. Employers need to consider various factors to ensure compliance and efficiency. Below, we discuss key employer considerations for managing cross-border taxation.

Payroll Management

Employers must navigate payroll management when employees work remotely from different countries. This involves understanding and adhering to the local tax laws. Employers should also ensure correct tax withholding for each jurisdiction.

- Register for payroll in each country where employees work.

- Understand the tax rates and regulations in those countries.

- Ensure timely and accurate payroll processing to avoid penalties.

Employers can use specialized payroll software to manage these complexities. This software can automate tax calculations and ensure compliance. It can also help in generating necessary reports for each jurisdiction.

Legal Obligations

Employers have various legal obligations when managing remote workers across borders. They must ensure compliance with local labor laws and regulations. This includes understanding work permits and employment contracts.

Here are key legal considerations:

| Legal Aspect | Consideration |

|---|---|

| Work Permits | Check if remote workers need work permits. |

| Employment Contracts | Ensure contracts comply with local laws. |

| Employee Benefits | Provide benefits according to local regulations. |

Employers should consult with local legal experts. This helps in navigating the complexities of cross-border employment laws. Regular audits can also ensure ongoing compliance with local regulations.

Tax Planning Strategies

Working remotely across borders has become a norm. This brings tax challenges. Effective tax planning strategies can help manage these challenges. Below, we discuss key strategies for efficient cross-border taxation.

Tax-efficient Structures

Choosing the right tax-efficient structures is crucial. Here are some common structures:

- Offshore companies: These can reduce tax liabilities.

- Double Tax Agreements (DTAs): DTAs avoid double taxation.

- Tax residency planning: Choose a country with favorable tax laws.

These structures can help optimize your tax obligations. Always ensure compliance with local and international laws.

Professional Advice

Seeking professional advice is essential for cross-border taxation. A tax advisor can help you navigate complex rules. Here are some benefits:

- Expert knowledge: Advisors know the latest tax laws.

- Customized solutions: They tailor strategies to your needs.

- Risk reduction: Minimize the risk of legal issues.

Professionals can also help with tax filings and compliance. This ensures you avoid penalties and fines.

Here is a table summarizing key points:

| Strategy | Benefit |

|---|---|

| Offshore companies | Reduce tax liabilities |

| Double Tax Agreements | Avoid double taxation |

| Tax residency planning | Favorable tax laws |

| Professional advice | Expert guidance |

Effective tax planning strategies are essential for remote workers. These strategies can help you save money and stay compliant.

Case Studies

Understanding cross border taxation for remote workers can be complex. By examining real-world case studies, we can gain valuable insights. Below are some examples and lessons learned from various scenarios.

Real-world Examples

Let’s look at some real-world examples of cross border taxation for remote workers:

| Case Study | Country | Outcome |

|---|---|---|

| John’s Experience | USA and Canada | Double Taxation Avoided |

| Maria’s Situation | Germany and Spain | Tax Credit Applied |

| Lee’s Challenge | Australia and UK | Tax Treaty Benefits |

John works remotely from Canada for a US company. He faced potential double taxation. By consulting a tax expert, he leveraged the tax treaty between the USA and Canada. John successfully avoided double taxation.

Maria is a remote worker in Spain for a German employer. She was subject to taxation in both countries. By applying for a tax credit in Spain, she offset her German taxes. This significantly reduced her overall tax burden.

Lee works from the UK for an Australian company. He encountered tax challenges due to differing tax laws. Through the tax treaty between Australia and the UK, Lee gained significant tax benefits. This streamlined his tax obligations.

Lessons Learned

These case studies offer several important lessons:

- Consult Tax Experts: Professional advice helps navigate complex tax laws.

- Understand Tax Treaties: Tax treaties can prevent double taxation.

- Apply for Tax Credits: Tax credits can offset foreign taxes.

Understanding these elements can make cross border taxation manageable. These lessons help remote workers comply with tax laws efficiently.

Future Trends

The future of cross border taxation for remote work is evolving. With more people working remotely, tax regulations will change. Technology will also play a big role. Let’s explore these future trends.

Evolving Regulations

Tax laws are changing to keep up with remote work. Governments are creating new rules. These rules will help manage cross border taxation.

Some countries may offer tax incentives. These incentives attract remote workers. Other countries may increase taxes for remote workers.

Here are some key points about evolving regulations:

- New tax treaties between countries

- Digital nomad visas

- Tax incentives for remote workers

- Increased compliance requirements

Impact Of Technology

Technology will change how cross border taxation works. New tools will help track remote work.

These tools will make it easier to follow tax laws. They will also help governments enforce these laws.

Here are some key technological impacts:

- Advanced tracking software for remote work

- Blockchain for secure tax records

- AI-driven tax compliance tools

- Cloud-based platforms for tax management

Cross border taxation for remote work is changing fast. Evolving regulations and technology will shape the future.

Credit: www.iota-tax.org

Credit: digitalnomads.world

Frequently Asked Questions

What Is Cross Border Taxation?

Cross border taxation refers to the tax implications of earning income in one country while residing in another. It involves understanding tax laws in both countries.

How Does Remote Work Affect Taxes?

Remote work can complicate taxes due to differing tax laws between countries. You may owe taxes in both your home and work countries.

Do I Need To Pay Taxes In Both Countries?

You might need to pay taxes in both countries. Double taxation agreements can help reduce this burden, depending on the countries involved.

What Are Tax Treaties?

Tax treaties are agreements between two countries to avoid double taxation. They determine which country has the right to tax specific income sources.

Conclusion

Navigating cross border taxation for remote work can be complex. Understanding regulations helps avoid pitfalls. Consult a tax professional for tailored advice. Stay informed and compliant to enjoy the benefits of remote work without tax worries. Proper planning ensures smooth financial management and peace of mind.